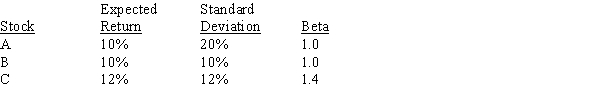

Consider the following information for three stocks,A,B,and C.The stocks' returns are positively but not perfectly positively correlated with one another,i.e.,the correlations are all between 0 and 1.  Portfolio AB has half of its funds invested in Stock A and half in Stock B.Portfolio ABC has one third of its funds invested in each of the three stocks.The risk-free rate is 5%,and the market is in equilibrium,so required returns equal expected returns.Which of the following statements is CORRECT?

Portfolio AB has half of its funds invested in Stock A and half in Stock B.Portfolio ABC has one third of its funds invested in each of the three stocks.The risk-free rate is 5%,and the market is in equilibrium,so required returns equal expected returns.Which of the following statements is CORRECT?

Definitions:

Production Order Quantity Model

An economic order quantity technique applied to production orders.

Production Departments

Divisions within a manufacturing or production company responsible for the actual production of goods or services.

Demand Rate

refers to the speed at which customers purchase or demand a product or service over a given period of time.

Production Order Quantity Model

An inventory management technique that determines the optimal quantity of products to order or produce, minimizing total inventory costs.

Q32: To help finance a major expansion,Castro Chemical

Q32: Your brother's business obtained a 30-year amortized

Q47: Which of the following statements is CORRECT?<br>A)If

Q62: A basic rule in capital budgeting is

Q67: Suppose Community Bank offers to lend you

Q76: The text identifies three methods for estimating

Q77: Suppose the real risk-free rate is 3.50%

Q78: Which of the following statements is CORRECT?<br>A)In

Q100: A conflict will exist between the NPV

Q158: You want to go to Europe 5