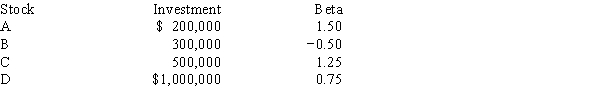

Consider the following information and then calculate the required rate of return for the Global Investment Fund,which holds 4 stocks.The market's required rate of return is 13.25%,the risk-free rate is 7.00%,and the Fund's assets are as follows:

Definitions:

Split-Brain Patient

An individual who has had the corpus callosum, the connective bridge between the two hemispheres of the brain, severed, often used to study the separate functions of the brain hemispheres.

Left Visual Field

The part of the visual field perceived by the right hemisphere of the brain, encompassing the left side of the environment as seen by each eye.

Right Visual Field

The right visual field pertains to the part of the environment perceived by the right half of the retina in each eye, processed primarily by the brain's left hemisphere.

Contralateral Neglect

Ignoring a part of the body or world on the side opposite (contralateral to) that of a brain injury.

Q1: An important part of the capital budgeting

Q12: Which is the best measure of risk

Q27: Malholtra Inc.is considering a project that has

Q42: Southwest U's campus book store sells course

Q43: Modigliani and Miller (MM)won Nobel Prizes for

Q61: If you plotted the returns of a

Q73: A stock with a beta equal to

Q76: A company is planning to raise $1,000,000

Q98: Cheng Inc.is considering a capital budgeting project

Q155: Which of the following statements is CORRECT,assuming