Exhibit 10.1

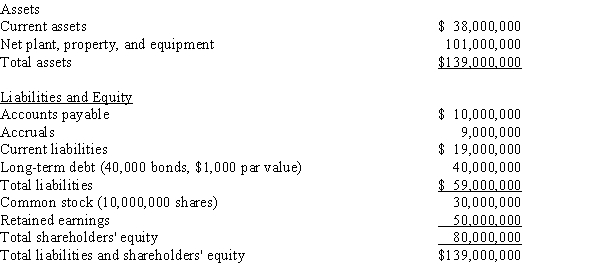

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 10.1.What is the best estimate of the firm's WACC?

Definitions:

Employee Referral

A program where existing employees are rewarded for referring qualified candidates for employment in the same company.

Employee Benefit

Non-wage compensation provided to employees, which may include health insurance, retirement plans, and paid vacation.

Wages

Payments made by employers to employees for their labor or services, typically calculated on an hourly, daily, or piecework basis.

Salaries

Regular payments made by an employer to an employee, typically monthly, for the professional services the employee provides.

Q1: Suppose a firm that has been earning

Q15: Which of the following statements is CORRECT?<br>A)The

Q23: In the foreseeable future,the real risk-free rate

Q32: New Orleans Builders Inc.has the following data.If

Q33: If on January 3,2015,a company declares a

Q43: A mutual fund manager has a $40

Q71: Underlying the dividend irrelevance theory proposed by

Q80: The cost of capital used in capital

Q99: The NPV method's assumption that cash inflows

Q107: Which of the following statements is CORRECT?<br>A)Other