Exhibit 10.1

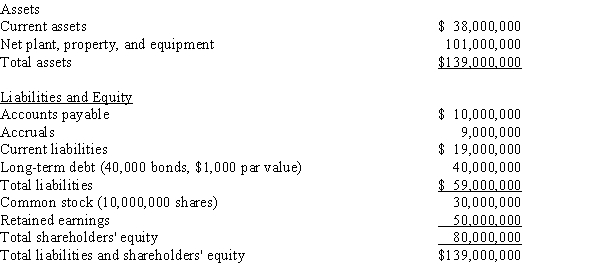

Assume that you have been hired as a consultant by CGT, a major producer of chemicals and plastics, including plastic grocery bags, styrofoam cups, and fertilizers, to estimate the firm's weighted average cost of capital. The balance sheet and some other information are provided below.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

The stock is currently selling for $15.25 per share, and its noncallable $1,000 par value, 20-year, 7.25% bonds with semiannual payments are selling for $875.00. The beta is 1.25, the yield on a 6-month Treasury bill is 3.50%, and the yield on a 20-year Treasury bond is 5.50%. The required return on the stock market is 11.50%, but the market has had an average annual return of 14.50% during the past 5 years. The firm's tax rate is 40%.

-Refer to Exhibit 10.1.Which of the following is the best estimate for the weight of debt for use in calculating the WACC?

Definitions:

Gustatory Information

Data or sensory input related to the sense of taste.

Cranial Nerves

Nerves that emerge directly from the brain, including the brainstem, responsible for sensory and motor functions of the head and neck.

Hypoglossal

Relating to the twelfth cranial nerve, which controls the muscles of the tongue, essential for swallowing and speech.

Emotional Pain

A deeply unpleasant emotional response resulting from significant loss, social rejection, or emotional neglect.

Q12: O'Brien Ltd.'s outstanding bonds have a $1,000

Q12: An increase in the debt ratio will

Q43: Which of the following statements is CORRECT?<br>A)The

Q52: A stock is expected to pay a

Q55: Inventory management is largely self-contained in the

Q59: If investors are risk averse and hold

Q75: Changes in a firm's collection policy can

Q79: As assistant to the CFO of Boulder

Q81: Since receivables and payables both result from

Q83: Which of the following statements is CORRECT?<br>A)If