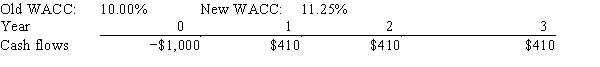

Last month,Lloyd's Systems analyzed the project whose cash flows are shown below.However,before the decision to accept or reject the project,the Federal Reserve took actions that changed interest rates and therefore the firm's WACC.The Fed's action did not affect the forecasted cash flows.By how much did the change in the WACC affect the project's forecasted NPV? Note that a project's projected NPV can be negative,in which case it should be rejected.

Definitions:

Average Collection Period

The average number of days it takes for a business to collect its accounts receivable.

Accounts Receivable

Money owed to a company by its customers for goods or services that have been delivered or used but not yet paid for.

Sales on Account

Transactions in which revenue is accounted for at the time of sale, but payment is deferred to a later date.

Operating Cycle

The period between the acquisition of inventory and the collection of cash from receivables, indicating the efficiency of a company's operations.

Q13: The risk-free rate is 6% and the

Q17: For a company whose target capital structure

Q21: The IRR method is based on the

Q32: You are considering two bonds.Bond A has

Q33: Datta Computer Systems is considering a project

Q41: Which of the following statements is CORRECT?<br>A)The

Q41: Simms Corp.is considering a project that has

Q81: Which of the following statements is CORRECT?<br>A)When

Q94: The risk to the firm of borrowing

Q127: The SML relates required returns to firms'