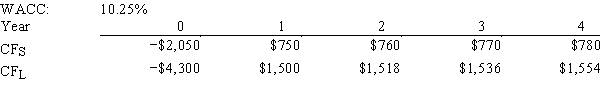

Sexton Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,so no value will be lost if the IRR method is used.

Definitions:

Group Interaction

The dynamics and communication that occur among members of a group working together.

Job Autonomy

The freedom and independence to make decisions and control one's work processes and environment without excessive supervision.

Group Bonus

A reward given to a team or group of employees for achieving significant goals or completing a project successfully.

Mutual Support

The provision of assistance, encouragement, and comfort between members of a group, leading to a stronger collective.

Q5: The first,and most critical,step in constructing a

Q10: Banerjee Inc.wants to maintain a target capital

Q17: Project S has a pattern of high

Q52: Superior analytical techniques,such as NPV,used in combination

Q70: A firm buys on terms of 3/15,net

Q75: You are on the staff of Camden

Q89: The corporate valuation model cannot be used

Q92: Which of the following is NOT a

Q99: The NPV method's assumption that cash inflows

Q108: Which of the following statements is CORRECT?<br>A)If