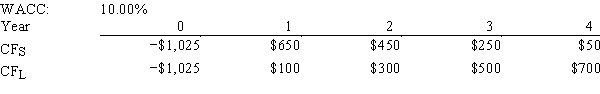

Moerdyk & Co.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,i.e.,no conflict will exist.

Definitions:

Reputational View

A perspective that emphasizes the importance of an individual's reputation, or how others perceive them, in social contexts or interactions.

Social Cognition

The study of how people process, store, and apply information about others and social situations, including understanding and reacting to the behaviors of others.

Parental-intervention

Actions taken by parents to influence or support their child's development, well-being, or behavior.

Bullying

The act of intimidating or mistreating someone weaker or perceived as vulnerable.

Q1: Refer to Exhibit 16.1.Assume now that the

Q5: The first,and most critical,step in constructing a

Q23: Which of the following statements is CORRECT?<br>A)Put

Q53: Net working capital is defined as current

Q57: Your uncle is considering investing in a

Q62: Firms U and L each have the

Q67: A 100% stock dividend and a 2:<br>1

Q87: Assume that the risk-free rate is 6%

Q92: You have the following data on three

Q103: On average,a firm collects checks totaling $250,000