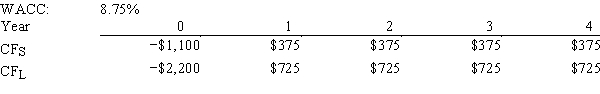

Nast Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV,how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost.

Definitions:

Critical Rationalists

Individuals who advocate for the approach of systematically questioning and critically examining one's own beliefs and views.

Abraham and Isaac

A biblical story from the Book of Genesis about Abraham's faith being tested by God, who commands him to sacrifice his son Isaac, before stopping him at the last moment.

Essentially

At its core or in its most important aspects.

Confucianism

An ethical and philosophical system developed from the teachings of the Chinese philosopher Confucius, focusing on morality, family loyalty, and respect for elders.

Q5: If investors prefer firms that retain most

Q12: The relative risk of a proposed project

Q17: Which of the following statements is CORRECT?

Q18: You were hired as a consultant to

Q20: Jill Angel holds a $200,000 portfolio consisting

Q24: Which of the following statements is CORRECT?<br>A)Sensitivity

Q48: Which of the following statements is most

Q57: A 12-year bond has an annual coupon

Q66: Other things held constant,an increase in the

Q88: Projects S and L both have an