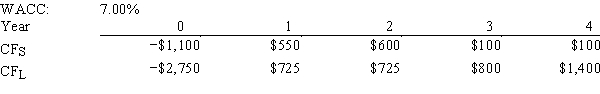

Noe Drilling Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR,how much,if any,value will be forgone,i.e.,what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

Definitions:

Prenatal Development

The process of growth and development within the womb from conception to birth.

Developmental Psychologists

Professionals who study the psychological growth and development that occurs throughout a lifespan.

Genetic Predispositions

The increased likelihood of developing a particular disease or condition based on an individual's genetic makeup.

Cognitive Changes

Alterations in cognitive functions such as memory, problem-solving, and attention that can occur due to aging, neurological diseases, or psychological conditions.

Q8: Aggarwal Inc.buys on terms of 2/10,net 30,and

Q14: Foley Systems is considering a new investment

Q18: The slope of the SML is determined

Q31: Firm M is a mature company in

Q33: If on January 3,2015,a company declares a

Q40: Traditional discounted cash flow (DCF)analysis--where a project's

Q40: Cornell Enterprises is considering a project that

Q74: Helena Furnishings wants to reduce its cash

Q104: Barry Company is considering a project that

Q127: The SML relates required returns to firms'