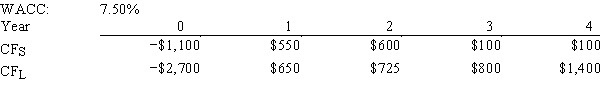

Tesar Chemicals is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the NPV.If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV,how much,if any,value will be forgone,i.e.,what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.NPV will have no effect on the value gained or lost.

Definitions:

Fixed Budget

A budget that remains constant regardless of changes in the level of activity or volume, typically used for planning purposes.

Variable Costs

Outlays that fluctuate according to the amount of production or volume of sales.

Flexible Budget Performance Report

A report comparing actual operating results to a budget that adjusts with changes in the volume of activity.

Contribution Margin

The difference between sales revenue and variable costs, indicating how much revenue is contributing to fixed costs and profit.

Q16: Under certain conditions,a project may have more

Q26: LA Moving Company has the following data,dollars

Q31: Firm M is a mature company in

Q37: Harry's Inc.is considering a project that has

Q40: Shorter-term cash budgets (such as a daily

Q58: If the IRR of normal Project X

Q59: Which of the following statements is CORRECT?<br>A)All

Q59: Miller and Modigliani's dividend irrelevance theory says

Q74: Helena Furnishings wants to reduce its cash

Q96: A firm constructing a new manufacturing plant