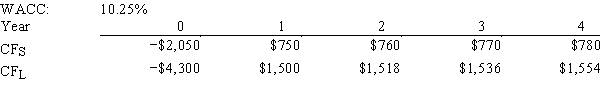

Sexton Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.If the decision is made by choosing the project with the higher IRR,how much value will be forgone? Note that under certain conditions choosing projects on the basis of the IRR will not cause any value to be lost because the one with the higher IRR will also have the higher NPV,so no value will be lost if the IRR method is used.

Definitions:

Federal Funds Rate

The interest rate at which depository institutions lend reserve balances to other depository institutions overnight on an uncollateralized basis.

Reserve Requirement

The portion of depositors' balances that banks must have on hand as cash or in deposits with the central bank, used as a tool for monetary policy.

Bank Runs

A situation where a large number of a bank's depositors try to withdraw their funds simultaneously over concerns about the bank's solvency.

Reserve Banking

A banking system in which banks hold a fraction of their deposits in reserve, while lending out the remainder to generate profits.

Q2: A 6-month call option on Meyers Inc.'s

Q23: Southwest U's campus book store sells course

Q35: The NPV and IRR methods,when used to

Q54: Which of the following statements is CORRECT?<br>A)Assume

Q56: Portland Plastics Inc.has the following data.If it

Q58: Other things held constant,which of the following

Q63: If expectations for long-term inflation rose,but the

Q78: A company is considering a new project.The

Q79: Which of the following statements is CORRECT?<br>A)Collections

Q134: Because of differences in the expected returns