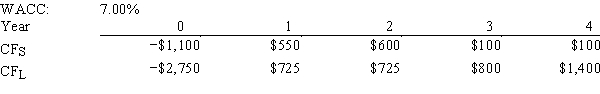

Noe Drilling Inc.is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the MIRR.If the decision is made by choosing the project with the higher IRR rather than the one with the higher MIRR,how much,if any,value will be forgone,i.e.,what's the NPV of the chosen project versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.MIRR will have no effect on the value lost.

Definitions:

Profit of Shareholders

The portion of a company's profits that is allocated to stockholders, often seen as a primary goal of businesses to maximize shareholder value.

Shareholder Orientation

A business approach that prioritizes the interests and value maximization for shareholders, often guiding strategic and operational decisions.

Welfare of Society

The overall health, happiness, and well-being of a community or civilization, often considered in economic and social policies.

Collusion

An agreement between parties, often secretly, to limit open competition by deceiving or defrauding others of their legal rights, or to obtain an objective forbidden by law typically by defrauding or gaining an unfair market advantage.

Q2: Accelerated depreciation has an advantage for profitable

Q3: Which of the following statements is CORRECT?<br>A)To

Q20: Suppose a CBOT 10-year U.S.Treasury note futures

Q29: The option to abandon a project is

Q37: Harry's Inc.is considering a project that has

Q56: It is extremely difficult to estimate the

Q64: Francis Inc.'s stock has a required rate

Q64: A firm should never accept a project

Q65: Reddick Enterprises' stock currently sells for $35.50

Q90: Ehrmann Data Systems is considering a project