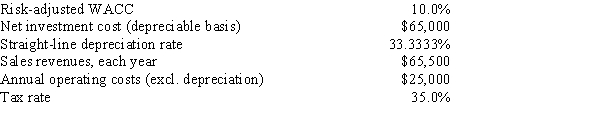

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life,would be depreciated by the straight-line method over its 3-year life,and would have a zero salvage value.No change in net operating working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV?

Definitions:

High-Technology Inventor

An individual or group involved in creating innovative products or systems that rely on advanced scientific and engineering knowledge.

Investor

An individual or entity that allocates capital with the expectation of receiving financial returns.

Employee Stock Ownership Plans (ESOPs)

An employee benefit plan giving workers ownership interest in the company, often aimed at improving company performance and employee satisfaction.

Funding Sources

Various origins of financial support for businesses or projects, including loans, investments, grants, and personal savings.

Q1: Rebello's preferred stock pays a dividend of

Q7: Which of the following statements is CORRECT?<br>A)If

Q10: Which of the following statements is CORRECT?

Q15: Which of the following statements is CORRECT?<br>A)Under

Q17: The Y-axis intercept of the SML indicates

Q19: You must estimate the intrinsic value of

Q31: A commercial bank recognizes that its net

Q32: Lissa Co.'s stock price is currently $30.25.A

Q61: If you plotted the returns of a

Q68: Maxwell Feed & Seed is considering a