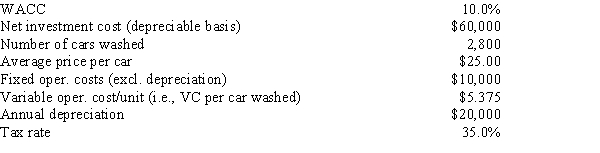

Florida Car Wash is considering a new project whose data are shown below.The equipment to be used has a 3-year tax life,would be depreciated on a straight-line basis over the project's 3-year life,and would have a zero salvage value after Year 3.No change in net operating working capital would be required.Revenues and other operating costs will be constant over the project's life,and this is just one of the firm's many projects,so any losses on it can be used to offset profits in other units.If the number of cars washed declined by 40% from the expected level,by how much would the project's NPV change? (Hint: Note that cash flows are constant at the Year 1 level,whatever that level is.)

Definitions:

Job Performance

The evaluation of the efficiency, effectiveness, and quality of an employee's work in fulfilling their job responsibilities and objectives.

Big Five Dimensions

A model outlining five broad dimensions used to describe human personality, including openness, conscientiousness, extraversion, agreeableness, and neuroticism.

Unemployment

A situation where individuals who are capable of working and are actively seeking employment are unable to find a job.

Adulthood

The stage of life characterized by the attainment of full growth and maturity, typically marked by increased responsibilities and independence.

Q5: An investor who "writes" a call option

Q6: Projects A and B have identical expected

Q14: There are two types of dividend reinvestment

Q27: In theory,reducing the volatility of its cash

Q28: When deciding whether or not to take

Q57: Assume that Kish Inc.hired you as a

Q60: The full amount of a lease payment

Q64: A firm's peak borrowing needs will probably

Q80: Which of the following is NOT commonly

Q119: Refer to Exhibit 16.1.What's the difference in