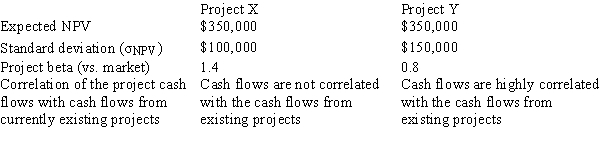

Taussig Technologies is considering two potential projects,X and Y.In assessing the projects' risks,the company estimated the beta of each project versus both the company's other assets and the stock market,and it also conducted thorough scenario and simulation analyses.This research produced the following data:

Which of the following statements is CORRECT?

Which of the following statements is CORRECT?

Definitions:

Units per Year

A measure of production output or activity volume, indicating the number of units produced or sold within a year.

ROI Computation

The calculation of Return on Investment, which measures the gain or loss generated on an investment relative to the amount of money invested.

Net Book Value

The value of an asset after accounting for depreciation or amortization found on a company's balance sheet.

Operating Expense

Expenses incurred from a company's operational activities, excluding cost of goods sold, such as selling, general, and administrative expenses.

Q2: Ross-Jordan Financial has suffered losses in recent

Q4: Your firm adheres strictly to the residual

Q4: Atlanta Cement,Inc.buys on terms of 2/15,net 30.It

Q21: Real options are valuable,and that value is

Q27: Assume that you hold a well-diversified portfolio

Q46: Atlas Corp.is considering two mutually exclusive projects.Both

Q68: Florida Car Wash is considering a new

Q76: If a firm switched from taking trade

Q80: For a stock to be in equilibrium,that

Q90: Porter Inc's stock has an expected return