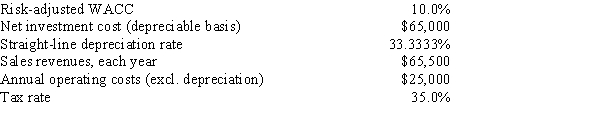

Temple Corp.is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life,would be depreciated by the straight-line method over its 3-year life,and would have a zero salvage value.No change in net operating working capital would be required.Revenues and other operating costs are expected to be constant over the project's 3-year life.What is the project's NPV?

Definitions:

Cash Flow Statement

This financial document provides a comprehensive view of a company's cash inflows from operations and investments, alongside the expenditures on business and investment actions within a designated timeframe.

Common Stock

A type of security that signifies ownership in a corporation and represents a claim on part of the corporation's profits or losses.

Generally Accepted Accounting Principles

A set of widely adhered to principles and guidelines for reporting financial information.

Financial Accounting Standards Board

An independent organization responsible for establishing and improving financial accounting and reporting standards in the United States.

Q26: Other things held constant,if the expected inflation

Q35: High Roller Properties is considering building a

Q67: Which of the following statements is CORRECT?<br>A)The

Q81: Carter's preferred stock pays a dividend of

Q83: The facts that (1)no explicit interest is

Q89: Duval Inc.uses only equity capital,and it has

Q97: Which of the following statements is CORRECT?<br>A)One

Q108: Which of the following statements is CORRECT?<br>A)If

Q113: Calculate the required rate of return for

Q123: The slope of the SML is determined