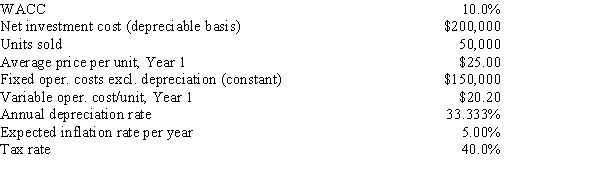

Desai Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years,it will be depreciated on a straight-line basis,and there will be no salvage value.No change in net operating working capital would be required.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.What is the project's expected NPV?

Definitions:

Opportunity Cost

The loss of potential gain from other alternatives when one alternative is chosen.

Leisure Time

Time available for ease and relaxation, where no work-related duties are expected, allowing for personal preferences in activities.

Marginal Productivity

The additional output resulting from the use of one more unit of a factor of production, holding other factors constant.

Labor-saving

Technologies or methods that decrease the amount of work required to produce goods or services, often leading to increased efficiency.

Q4: If debt is to be used to

Q9: When estimating the cost of equity by

Q16: Under certain conditions,a project may have more

Q18: Although the replacement chain approach is appealing

Q58: An increase in a firm's expected growth

Q59: If investors are risk averse and hold

Q64: Francis Inc.'s stock has a required rate

Q71: Assume that the risk-free rate is 5%.Which

Q92: Which of the following is NOT a

Q93: If a firm is privately owned,and its