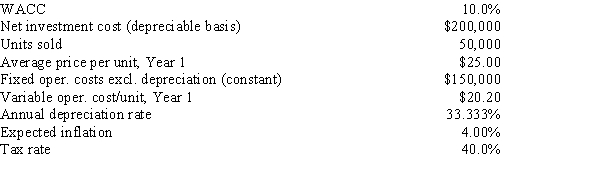

Poulsen Industries is analyzing an average-risk project,and the following data have been developed.Unit sales will be constant,but the sales price should increase with inflation.Fixed costs will also be constant,but variable costs should rise with inflation.The project should last for 3 years,it will be depreciated on a straight-line basis,and there will be no salvage value.No change in net operating working capital would be required.This is just one of many projects for the firm,so any losses on this project can be used to offset gains on other firm projects.The marketing manager does not think it is necessary to adjust for inflation since both the sales price and the variable costs will rise at the same rate,but the CFO thinks an inflation adjustment is required.What is the difference in the expected NPV if the inflation adjustment is made versus if it is not made?

Definitions:

Fiduciary Responsibilities

Obligations of an individual or entity to act in the best interest of another party, especially when managing their assets.

Social Egalitarian

A belief in equal rights, duties, and opportunities for all individuals in a society, regardless of their background or economic status.

Wealth Earned

Financial gains obtained through work, investment, or other means of income generation.

Distribute

To distribute means to give out or spread something widely among a number of recipients.

Q7: You hold a diversified $100,000 portfolio consisting

Q8: You have been hired by a new

Q17: The Y-axis intercept of the SML indicates

Q24: Which of the following is NOT a

Q31: Sheehan Inc.is deciding whether to invest in

Q63: Which of the following statements is CORRECT?<br>A)Using

Q67: Huang Company's last dividend was $1.25.The dividend

Q78: According to Modigliani and Miller (MM),in a

Q79: Assume that the economy is in a

Q80: Which of the following is NOT commonly