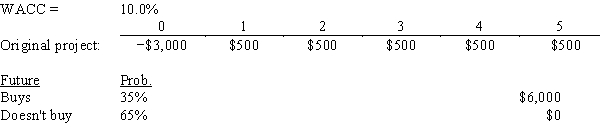

Tutor.com is considering a plan to develop an online finance tutoring package that has the cost and revenue projections shown below.One of Tutor's larger competitors,Online Professor (OP) ,is expected to do one of two things in Year 5: (1) develop its own competing program,which will put Tutor's program out of business,or (2) offer to buy Tutor's program if it decides that this would be less expensive than developing its own program.Tutor thinks there is a 35% probability that its program will be purchased for $6 million and a 65% probability that it won't be bought,and thus the program will simply be closed down with no salvage value.What is the estimated net present value of the project (in thousands) at a WACC = 10%,giving consideration to the potential future purchase?

Definitions:

Environmental Analysis

The process of evaluating the external factors that can affect an organization's success, such as political, economic, social, and technological factors.

Pollution

The introduction of contaminants into the natural environment, causing adverse change and harm to ecosystems.

Competitive Advantage

The attribute(s) that allows a company to outperform its competitors, providing it with a greater market share or profitability.

Sustainable

The quality of not being harmful to the environment or depleting natural resources, and thereby supporting long-term ecological balance.

Q18: When we use the AFN equation to

Q26: Leasing is often referred to as off-balance-sheet

Q27: The problem of dilution of stockholders' earnings

Q28: Mortal Inc.expects to have a capital budget

Q34: Which of the following statements is NOT

Q44: Toombs Media Corp.recently completed a 3-for-1 stock

Q52: For a project with one initial cash

Q59: Which of the following factors should be

Q86: Which of the following statements is CORRECT?<br>A)A

Q113: Zarruk Construction's DSO is 50 days (on