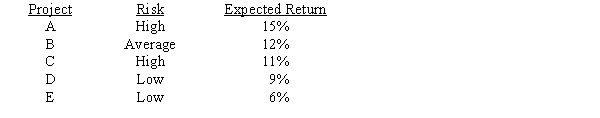

Langston Labs has an overall (composite) WACC of 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Langston evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

Definitions:

Government Mandates

Directives issued by the government that require individuals or organizations to comply with certain regulations, standards, or procedures.

National Health Insurance

A system wherein the government provides health insurance to its citizens, often funded through taxation.

Copayments

A fixed amount paid by a patient for receiving a particular service or medication, with the remaining balance covered by the health insurance.

Q1: Rebello's preferred stock pays a dividend of

Q8: You have been hired by a new

Q16: Although it is extremely difficult to make

Q22: The graphical probability distribution of ROE for

Q40: Which of the following statements is CORRECT?<br>A)Sensitivity

Q41: Which one of the following is an

Q46: Assume that you manage a $10.00 million

Q67: The primary advantage to using accelerated rather

Q80: Currently,Powell Products has a beta of 1.0,and

Q97: Which of the following statements is CORRECT?<br>A)One