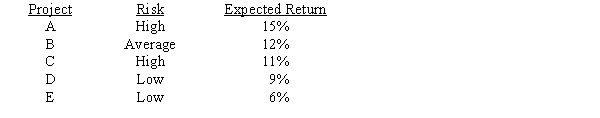

Langston Labs has an overall (composite) WACC of 10%,which reflects the cost of capital for its average asset.Its assets vary widely in risk,and Langston evaluates low-risk projects with a WACC of 8%,average-risk projects at 10%,and high-risk projects at 12%.The company is considering the following projects:

Which set of projects would maximize shareholder wealth?

Which set of projects would maximize shareholder wealth?

Definitions:

Elasticity of Demand

A gauge for understanding how price changes influence the consumer demand for a particular good.

Constant Elasticity

A condition where the elasticity of a function, such as demand or supply, remains unchanged over a range of prices or quantities.

Reduce Smoking

The act of decreasing the frequency or amount of tobacco consumption.

Elasticity of Demand

A measure of how much the quantity demanded of a good responds to a change in the price of that good, indicating consumer sensitivity to price changes.

Q35: Refer to Exhibit 20.1.What is the minimum

Q42: D.Paul Inc.forecasts a capital budget of $725,000.The

Q45: If a dollar will buy fewer units

Q49: The MacMillen Company has equal amounts of

Q60: The full amount of a lease payment

Q72: You work for Whittenerg Inc.,which is considering

Q93: Which of the following statements is CORRECT?<br>A)Under

Q98: Cheng Inc.is considering a capital budgeting project

Q98: Which of the following statements is CORRECT?

Q118: If a firm's suppliers stop offering discounts,then