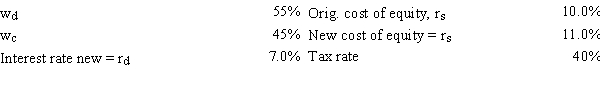

Gator Fabrics Inc.currently has zero debt .It is a zero growth company,and additional firm data are shown below.Now the company is considering using some debt,moving to the new capital structure indicated below.The money raised would be used to repurchase stock at the current price.It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat,as indicated below.If this plan were carried out,by how much would the WACC change,i.e.,what is WACCOld − WACCNew?

Definitions:

Formal Training

Structured educational programs designed to enhance the knowledge and skills of participants in a specific area or discipline.

Flexibility

The ability to adapt to changes, challenges, or new requirements quickly and efficiently.

Inner Feelings

Refers to the emotions and thoughts that reside within an individual, often private and not immediately apparent to others.

Developmental Assignments

Tasks or projects assigned to an individual that are designed to challenge, stretch, and ultimately contribute to their professional growth and development.

Q1: Errors in the sales forecast can be

Q6: A currency trader observes the following quotes

Q14: Foley Systems is considering a new investment

Q17: For a company whose target capital structure

Q25: A 6-month put option on Makler Corp.'s

Q35: Calculating a currency cross rate involves determining

Q40: Other things held constant,firms with more stable

Q46: If two firms have the same expected

Q48: The cost of debt,r<sub>d</sub>,is normally less than

Q57: If in the opinion of a given