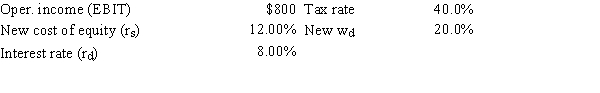

As a consultant to First Responder Inc.,you have obtained the following data (dollars in millions) .The company plans to pay out all of its earnings as dividends,hence g = 0.Also,no net new investment in operating capital is needed because growth is zero.The CFO believes that a move from zero debt to 20.0% debt would cause the cost of equity to increase from 10.0% to 12.0%,and the interest rate on the new debt would be 8.0%.What would the firm's total market value be if it makes this change? Hints: Find the FCF,which is equal to NOPAT = EBIT(1 − T) because no new operating capital is needed,and then divide by (WACC − g) .

Definitions:

Q3: One implication of the bird-in-the-hand theory of

Q5: Blenman Corporation,based in the United States,arranged a

Q13: Schiffauer Electronics plans to issue 10-year,zero coupon

Q21: The IRR method is based on the

Q25: Discounted cash flow methods are not appropriate

Q32: Marshall-Miller & Company is considering the purchase

Q48: Normal Projects S and L have the

Q49: Whited Products recently completed a 4-for-1 stock

Q65: Which of the following statements is CORRECT?

Q76: If a firm switched from taking trade