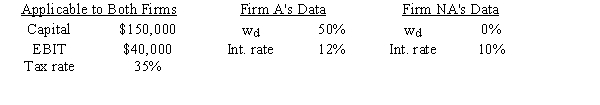

Firm A is very aggressive in its use of debt to leverage up its earnings for common stockholders,whereas Firm NA is not aggressive and uses no debt.The two firms' operations are identical⎯they have the same total investor-supplied capital,sales,operating costs,and EBIT.Thus,they differ only in their use of financial leverage (wd) .Based on the following data,how much higher or lower is A's ROE than that of NA,i.e.,what is ROEA − ROENA?

Definitions:

Direct Marketing

A type of advertising strategy that involves direct communication with consumers through various channels, bypassing intermediaries.

Promotional Mix

The combination of marketing communication tools a company uses to pursue its marketing objectives, such as advertising, sales promotion, public relations, personal selling, and direct marketing.

Promotion Decision Process

A series of steps a company undertakes to conceive, plan, and execute promotional activities to market its products or services.

Steps

Sequential actions or procedures followed to achieve a particular end.

Q3: How much should you be willing to

Q5: Stocks A and B have the following

Q6: Assume that the State of Florida sold

Q16: Which of the following statements is most

Q18: Which one of the following statements best

Q52: Curry Corporation is setting the terms on

Q65: A "reverse split" reduces the number of

Q84: Your company plans to produce a new

Q86: Which of the following actions would be

Q116: Swim Suits Unlimited is in a highly