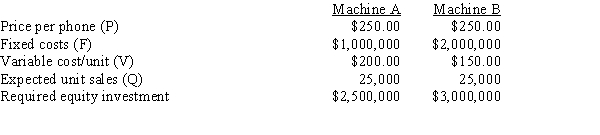

Your company,which is financed entirely with common equity,plans to manufacture a new product,a cell phone that can be worn like a wristwatch.Two robotic machines are available to make the phone,Machine A and Machine B.The price per phone will be $250.00 regardless of which machine is used to make it.The fixed and variable costs associated with the two machines are shown below,along with the capital (all equity) that must be invested to purchase each machine.The expected sales level is 25,000 units.Your company has tax loss carry-forwards that will cause its tax rate to be zero for the life of the project,so T = 0.How much higher or lower will the project's ROE be if you select the machine that produces the higher ROE,i.e.,what is ROEB − ROEA? (Hint: Since the firm uses no debt and its tax rate is zero,ROE = EBIT/Required investment.)

Definitions:

Consignor Ownership

Describes a situation where goods are given to another party (consignee) to sell, but the original party (consignor) retains ownership until the goods are sold.

Consignee

The party or entity that receives goods for sale, storage, or transfer but does not take ownership of those goods until they are sold.

LIFO Inventory Method

"Last-In, First-Out" is an accounting method for valuing inventory where the most recently produced items are recorded as sold first.

Physical Inventory

The process of counting all physical merchandise or stock in a business at a specific time to verify the quantities on hand.

Q22: The cash flows relevant for a foreign

Q23: Real options are options to buy real

Q25: Discounted cash flow methods are not appropriate

Q26: Leveraged buyouts (LBOs)occur when a firm's managers,generally

Q36: The purchase of assets at below their

Q43: Which of the following statements is CORRECT?<br>A)The

Q51: Which of the following statements is CORRECT?

Q57: Liberty Services is now at the end

Q59: A.Butcher Timber Company hired your consulting firm

Q80: Which of the following is NOT commonly