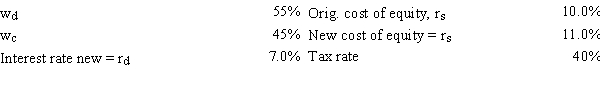

Gator Fabrics Inc.currently has zero debt .It is a zero growth company,and additional firm data are shown below.Now the company is considering using some debt,moving to the new capital structure indicated below.The money raised would be used to repurchase stock at the current price.It is estimated that the increase in risk resulting from the additional leverage would cause the required rate of return on equity to rise somewhat,as indicated below.If this plan were carried out,by how much would the WACC change,i.e.,what is WACCOld − WACCNew?

Definitions:

Q6: Which of the following statements is CORRECT?<br>A)Perhaps

Q13: Which one of the following would NOT

Q20: A firm that bases its capital budgeting

Q22: Which of the following statements concerning risk

Q27: For a zero-growth firm,it is possible to

Q30: Which of the following statements is CORRECT?<br>A)If

Q49: The MacMillen Company has equal amounts of

Q57: NY Fashions has the following data.If it

Q60: Tuttle Enterprises is considering a project that

Q116: Swim Suits Unlimited is in a highly