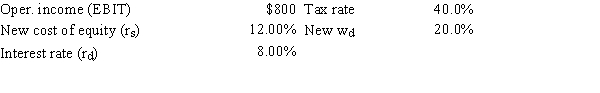

As a consultant to First Responder Inc.,you have obtained the following data (dollars in millions) .The company plans to pay out all of its earnings as dividends,hence g = 0.Also,no net new investment in operating capital is needed because growth is zero.The CFO believes that a move from zero debt to 20.0% debt would cause the cost of equity to increase from 10.0% to 12.0%,and the interest rate on the new debt would be 8.0%.What would the firm's total market value be if it makes this change? Hints: Find the FCF,which is equal to NOPAT = EBIT(1 − T) because no new operating capital is needed,and then divide by (WACC − g) .

Definitions:

Peptide Coupling Reagent

A chemical used to facilitate the formation of peptide bonds between amino acids during the synthesis of peptides or proteins.

Solid Phase Peptide Synthesis

A method for synthesizing peptides by anchoring the C-terminal of the peptide to an insoluble resin and sequentially adding amino acid residues.

Chymotrypsin

A digestive enzyme classified as a serine protease, which hydrolyzes proteins to form smaller peptides, playing a critical role in protein digestion.

Peptide Structure

The sequence and chemical bonding of amino acids in a peptide, which dictates its three-dimensional shape and function.

Q14: Which of the following is a key

Q18: You were hired as a consultant to

Q19: The cost of capital may be different

Q26: Leasing is often referred to as off-balance-sheet

Q39: Which of the following statements is CORRECT?<br>A)The

Q41: Currently,a U.S.trader notes that in the 6-month

Q42: One of the effects of ceasing to

Q75: Companies HD and LD have identical tax

Q105: The primary reason that the NPV method

Q111: Affleck Inc.'s business is booming,and it needs