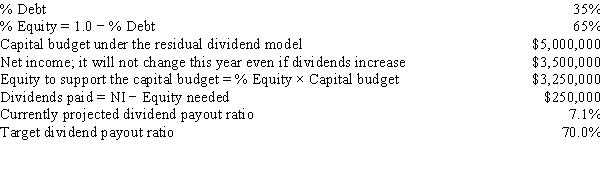

Walter Industries is a family owned concern.It has been using the residual dividend model,but family members who hold a majority of the stock want more cash dividends,even if that means a slower future growth rate.Neither the net income nor the capital structure will change during the coming year as a result of a dividend policy change to the indicated target payout ratio.By how much would the capital budget have to be cut to enable the firm to achieve the new target dividend payout ratio?

Definitions:

Scatterplot

A kind of graph using Cartesian coordinates that represents data points for usually two variables.

Re-expression

The process of transforming data using mathematical operations to make it easier to model or interpret.

Weight

A measurement or quantity indicating how heavy an object is, often measured in units such as kilograms, pounds, or tons.

Fat

Fat is a macronutrient composed of fatty acids, essential for energy storage, hormone production, and protecting vital organs in the body.

Q4: You have $5,436.60 in an account that

Q4: The cost of preferred stock to a

Q5: Trade credit can be separated into two

Q7: In a financial merger,the relevant post-merger cash

Q22: The CFO of Lenox Industries hired you

Q37: Other things held constant,the lower a firm's

Q45: Refer to Exhibit 20.1.What is the bond's

Q61: Which of the following statements is CORRECT?<br>A)A

Q79: If a firm buys on terms of

Q119: Other things equal,a tariff is:<br>A) superior to