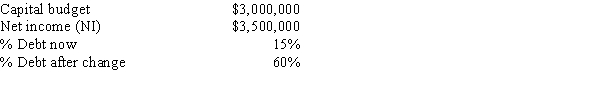

Clark Farms Inc.has the following data,and it follows the residual dividend model.Currently,it finances with 15% debt.Some Clark family members would like for the dividends to be increased.If Clark increased its debt ratio,which the firm's treasurer thinks is feasible,by how much could the dividend be increased,holding other things constant?

Definitions:

Return on Total Assets

A financial ratio that measures the profitability of a company in relation to its total assets, indicating how efficient management is at using its assets to generate earnings.

Interest Expense

A financial charge for borrowing money or the cost incurred on debt.

Net Income

The total profit of a company after all expenses and taxes have been subtracted from total revenue.

Financial Leverage

A difference between the rate of return on assets and the rate paid to creditors.

Q1: The component costs of capital are market-determined

Q8: A company currently sells 75,000 units annually.At

Q30: Which of the following statements is CORRECT?<br>A)If

Q32: Games Unlimited Inc.is considering a new game

Q33: An option that gives the holder the

Q34: Sutton Corporation,which has a zero tax rate

Q38: Typically,a project will have a higher NPV

Q42: One of the effects of ceasing to

Q43: Your company,RMU Inc.,is considering a new project

Q72: Based on the corporate valuation model,the total