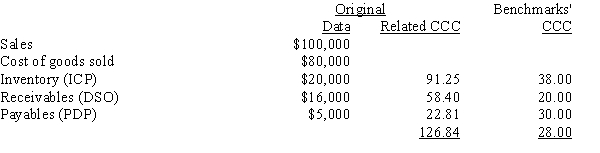

Soenen Inc.had the following data for last year (in millions) .The new CFO believes that the company could improve its working capital management sufficiently to bring its net working capital and cash conversion cycle up to the benchmark companies' level without affecting either sales or the costs of goods sold.Soenen finances its net working capital with a bank loan at an 8% annual interest rate,and it uses a 365-day year.If these changes had been made,by how much would the firm's pre-tax income have increased?

Definitions:

Rescission

Rescission is the legal act of canceling or terminating a contract, returning all parties involved to their positions before the contract was entered into.

Misrepresentation

A false statement or lie that induces someone to enter into a contract.

Xerox Copier

A brand of photocopier machines known for their document copying capabilities, often used generically to refer to photocopying.

Maintenance-Free

Products or systems designed to operate without needing regular maintenance or care from the user.

Q9: A firm's business risk is largely determined

Q15: The four primary elements in a firm's

Q16: Net operating working capital,defined as current assets

Q18: Although the replacement chain approach is appealing

Q28: Assume that in year 1 you pay

Q37: The longer its customers normally hold inventory,the

Q40: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" Refer to the

Q46: If two firms have the same expected

Q73: Changes in net operating working capital should

Q125: In one year the dollar would buy