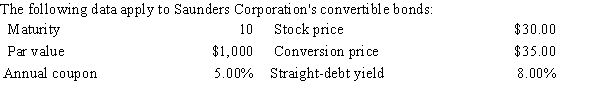

The next 4 problems must be kept together; all use the data in Exhibit 20.1.

Exhibit 20.1

-Refer to Exhibit 20.1.What is the minimum price (or "floor" price) at which the Saunders' bonds should sell?

Definitions:

Adjustable Rate Mortgage

A type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan according to market conditions.

Fixed Rate Mortgage

A mortgage in which the interest rate remains constant throughout the term of the loan.

Interest Rate

is the cost of borrowing money or the return on investment in a savings account, usually expressed as a percentage of the principal over a period of one year.

Tax Free Municipal Bond

A type of bond issued by local governments or their agencies, the interest from which is exempt from federal income taxes.

Q6: Assume that the State of Florida sold

Q10: According to Modigliani and Miller (MM),in a

Q14: A market in which the money of

Q18: What is one of the major shortcomings

Q23: Refer to Exhibit 20.1.What is the bond's

Q27: In a merger with true synergies,the post-merger

Q37: The longer its customers normally hold inventory,the

Q71: In a two-country model,equilibrium world prices and

Q72: Other things held constant,which of the following

Q103: On average,a firm collects checks totaling $250,000