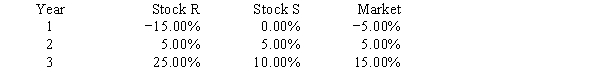

Exhibit 8A.1

You have been asked to use a CAPM analysis to choose between Stocks R and S, with your choice being the one whose expected rate of return exceeds its required return by the widest margin. The risk-free rate is 6%, and the required return on an average stock (or the "market") is 10%. Your security analyst tells you that Stock S's expected rate of return is equal to 11%, while Stock R's expected rate of return is equal to 12%. The CAPM is assumed to be a valid method for selecting stocks, but the expected return for any given investor (such as you) can differ from the required rate of return for a given stock. The following past rates of return are to be used to calculate the two stocks' beta coefficients, which are then to be used to determine the stocks' required rates of return:

Note: The averages of the historical returns are not needed, and they are generally not equal to the expected future returns.

-Refer to Exhibit 8A.1.Calculate both stocks' betas.What is the difference between the betas? That is,what is the value of betaR − betaS? (Hint: The graphical method of calculating the rise over run,or (Y2 − Y1) divided by (X2 − X1) may aid you.)

Definitions:

Common Share

Equity securities that represent ownership in a corporation, providing voting rights and a share in the company's profits via dividends.

Stockholders' Equity

The residual interest in the assets of a corporation remaining after deducting its liabilities, representing the ownership interest of the shareholders.

Dividend Yield

Dividend Yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price, indicating the return on investment from dividends alone.

Cash Dividends Per Share

The amount of cash distributed to shareholders per share out of a company's earnings.

Q9: Last year Handorf-Zhu Inc.had $850 million of

Q9: The incidence of poverty is very high

Q15: At the beginning of the year Giant

Q20: The "preferred" feature of preferred stock means

Q52: Suppose the world economy is composed of

Q57: Preferred stockholders have priority over common stockholders

Q71: The benefits-received principle of taxation is most

Q76: Assume that you pay $10,000 of tax

Q77: The burden of taxes in the United

Q146: Suppose that Jane earns $10,000 in year