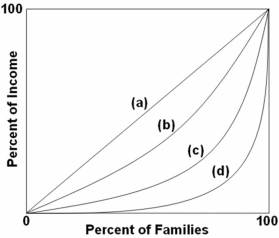

Refer to the above graph.If a curve shifted from (d) to (b) ,then the Gini ratio would:

Refer to the above graph.If a curve shifted from (d) to (b) ,then the Gini ratio would:

Definitions:

Cost of Capital

The critical rate of return a firm is required to earn on investment projects to hold its market stance and entice financiers.

NPV Method

Net Present Value method, a financial analysis tool used to determine the value of an investment by discounting future cash flows to their present value.

IRR Method

The IRR method, or Internal Rate of Return method, is a financial analysis tool used to evaluate the profitability of an investment by calculating the interest rate at which net present value of all the cash flows (both positive and negative) from a project or investment equals zero.

Cost of Capital

The rate of return required by a company to undertake an investment or project, often used as a discount rate in capital budgeting.

Q3: The positive view of advertising suggests that

Q13: Which would be evidence of more income

Q13: Schiffauer Electronics plans to issue 10-year,zero coupon

Q43: The chemical industry is highly capital-intensive.

Q79: If an American can purchase 40,000 British

Q100: Economists agree that corporations always shift the

Q123: Which is a barrier to entry?<br>A) Patents<br>B)

Q124: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4893/.jpg" alt=" The above diagram

Q129: As the area between the Lorenz curve

Q141: A characteristic of a purely competitive labor