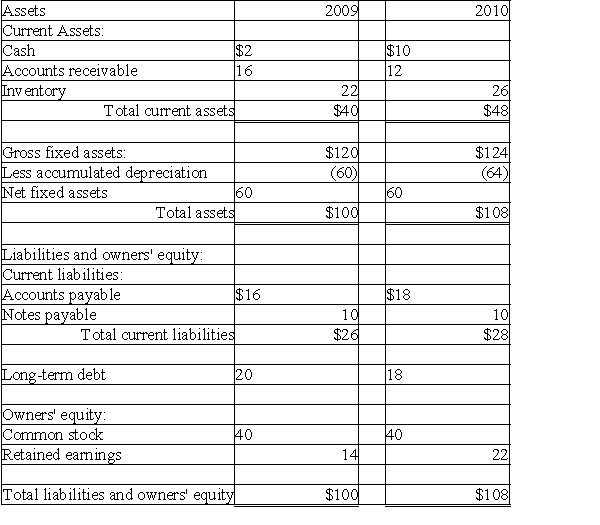

Please refer to Table 4-7 for the following question.

Table 4-7

Hokie Corporation Comparative Balance Sheet

For the Years Ending December 31, 2009 and 2010

(Millions of Dollars)

Hokie had net income of $28 million for 2010 and paid total cash dividends of $20 million to their common stockholders.

Hokie had net income of $28 million for 2010 and paid total cash dividends of $20 million to their common stockholders.

-Certainty Corp.had total sales of $1,200,000 in 2010 (80 percent of its sales are credit).The company's gross profit margin is 25 percent,its ending inventory is $150,000,and its accounts receivable balance is $90,000.What additional amount of cash could the firm have generated if it had increased its inventory turnover ratio to 9.0 and reduced its average collection period to 28.21875 days?

Definitions:

Unsecured Creditors

Creditors who have loaned money without any specific collateral, meaning they have a lower priority in case of the debtor's bankruptcy.

Liabilities With Priority

Debts or obligations of a company that are given precedence over others for repayment, often in situations like bankruptcy.

Net Realizable Value

The estimated selling price of goods, minus the costs of completion and costs necessary to make the sale.

Total Unsecured Liabilities

Liabilities that are not protected by collateral or a guarantee, meaning that the lender does not have rights to specific assets if the borrower defaults.

Q1: Stock A has the following returns for

Q13: An investor buys a 20-year Bbb-rated corporate

Q47: An income statement may be represented as

Q58: The investment banker performs three basic functions:<br>

Q71: In general,the required rate of return is

Q75: Which of the following ratios would be

Q79: Which of the following best describes cash

Q92: The syndicate can be thought of as

Q108: How much money must be put into

Q122: Based on the information in Table 4-2,the