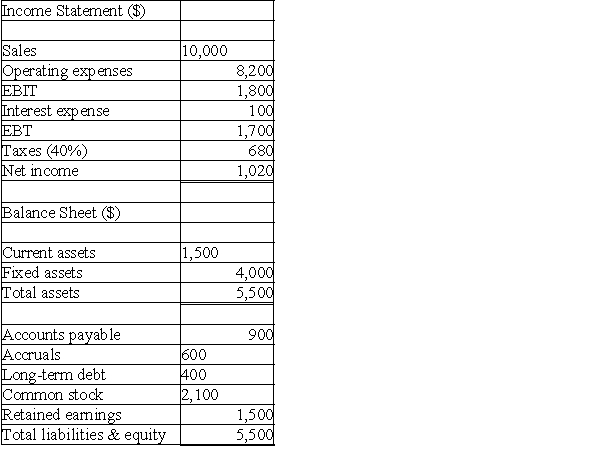

a.Using the financial statements for IUP Enterprises for 2010 (given below),calculate the return on equity,the debt ratio,and the times interest earned ratio.

b.Suppose the industry average debt ratio is 50%.Give one reason why the debt ratio for IUP Enterprises may be considered favorable,and give one reason why the debt ratio for IUP Enterprises may be considered unfavorable.

IUP Enterprises

2010 Financial Statements

Definitions:

Business Cycles

The fluctuations in economic activity that an economy experiences over a period of time, characterized by periods of boom and recession.

Great Recession

A global economic downturn that occurred from late 2007 through 2009, marked by severe financial crises, including the collapse of the housing market in the United States.

Peak

The highest point between the end of an economic expansion and the start of a contraction in a business cycle.

Unemployment

The condition of being without a job while actively looking for employment and being willing to work.

Q19: John calls his stockbroker and instructs him

Q20: Investment A and Investment B both have

Q37: If the interest rate is positive,a six-year

Q37: Assume that you have $100,000 invested in

Q39: How much money must you pay into

Q46: It is January 1st and Darwin Davis

Q55: What information does a firm's income statement

Q88: A company borrows $2,000,000 and uses the

Q140: Zevo Corp.bonds have a coupon rate of

Q147: Common stock is considered a short-term security