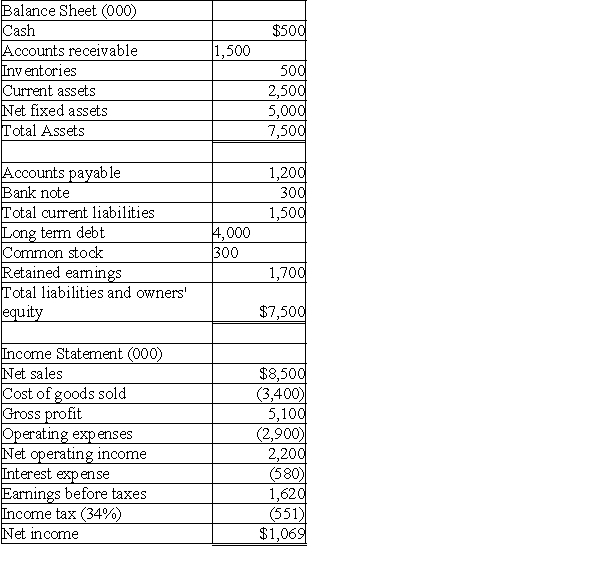

The balance sheet and income statement for Becker,Becker & Becker is presented below.

a.Compute the following ratios:

a.Compute the following ratios:

Current ratio,Acid test ratio,Debt ratio,Total asset turnover,Operating profit margin,Return on total investments,Times interest earned,Inventory turnover.

b.All other things equal,compute the dollar amount of sales needed to achieve an 18% return on total assets for the coming year.

c.Given Becker's inventory turnover ratio,find a way of computing the current level of inventory given this ratio and assuming the current level of inventories is unknown.Set up but do not solve.

Definitions:

Historical Cost

An accounting principle that requires assets to be recorded at their original purchase price, without adjusting for inflation or changes in market value.

New Venture

An enterprise that is newly established, focusing on addressing a market demand by offering an innovative product, service, or platform.

Expansion

The process of a business enlarging its operations, typically through increased production capabilities, market reach, or product lines.

New Market

An emerging sector or industry where a company can expand its operations or products to generate growth.

Q20: Transactions in the futures markets involve current

Q34: You wish to accumulate $10,000 by depositing

Q68: Table 3-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2782/.jpg" alt="Table 3-3

Q68: It is never appropriate to compare nominal

Q71: In general,the required rate of return is

Q75: The minimum rate of return necessary to

Q80: As interest rates,and consequently investors' required rates

Q91: Based on the information in Table 3-1,calculate

Q112: Auto Loans R Them loans you $24,000

Q154: Which of the following conclusions would be