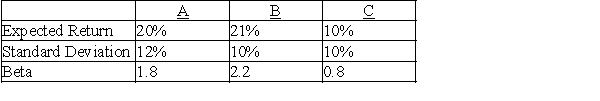

Answer the questions below using the following information on stocks A,B,and C.

Assume the risk-free rate of return is 3% and the expected market return is 12%

Assume the risk-free rate of return is 3% and the expected market return is 12%

a.Calculate the required return for stocks A,B,and C.

b.Assuming an investor with a well-diversified portfolio,which stock would the investor want

to add to his portfolio?

c.Assuming an investor who will invest all of his money into one security,which stock will the investor choose?

Definitions:

Brain Injury

Physical damage to the brain, which can result in temporary or permanent impairment of cognitive, physical, and psychosocial functions.

Immune Response

The body's defense mechanism against foreign substances or pathogens, involving both specific and nonspecific components.

Classical Conditioning

A learning process that occurs when two stimuli are repeatedly paired: a response that is at first elicited only by the second stimulus is eventually elicited by the first stimulus alone.

Conditioned Stimulus

An initially neutral signal that, once paired with an unconditioned stimulus, ultimately leads to eliciting a conditioned response.

Q49: Shafer Corporation issued callable bonds.The bonds are

Q60: A common method of evaluating a firm's

Q93: A firm can increase the growth rate

Q95: A common stock with an expected dividend

Q103: Last National Bank is offering you a

Q119: Whenever the internal rate of return on

Q119: In order to send your first child

Q121: Which of the following statements is true

Q122: Based on the information in Table 4-2,the

Q154: Which of the following conclusions would be