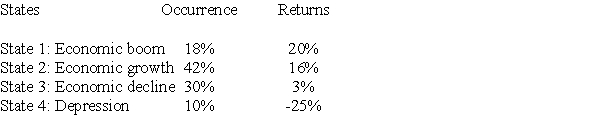

You are considering investing in a project with the following possible outcomes:

Probability of Investment Calculate the expected rate of return and standard deviation of returns for this investment,respectively.

Calculate the expected rate of return and standard deviation of returns for this investment,respectively.

Definitions:

Net Capital

The difference between a firm's total assets and its total liabilities, essentially representing the owner's equity.

Net Capital Outflows

The difference between a nation's outflow of capital to foreign countries and its incoming capital from abroad, showing how much a country's residents are investing in foreign assets compared to how much foreigners are investing in the domestic country.

Deficit Change

The amount by which a government, company, or individual's spending exceeds income over a particular period of time.

Exchange Rate

The price of one country's currency expressed in terms of another country's currency.

Q34: Net working capital is equal to gross

Q44: Corporations have two costs of common equity,one

Q70: Collectibles Corp.has a beta of 2.5 and

Q85: The prime lending rate is the base

Q91: In general,common stock and preferred stock are

Q97: In an efficient market,two investors may agree

Q101: SWH Corporation issued bonds on January 1,2004.The

Q132: If a bond's rating declines,the interest rate

Q133: Ratios that examine profit relative to investment

Q145: The less risky the bond (or the