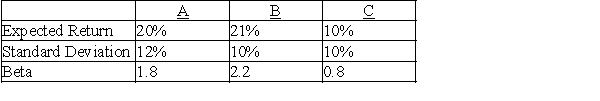

Answer the questions below using the following information on stocks A,B,and C.

Assume the risk-free rate of return is 3% and the expected market return is 12%

Assume the risk-free rate of return is 3% and the expected market return is 12%

a.Calculate the required return for stocks A,B,and C.

b.Assuming an investor with a well-diversified portfolio,which stock would the investor want

to add to his portfolio?

c.Assuming an investor who will invest all of his money into one security,which stock will the investor choose?

Definitions:

National Security

A state or country's goal to maintain the survival of the state through necessary measures, including economic security, strength in defense, and diplomacy.

Cold War

Term for tensions, 1945–1989, between the Soviet Union and the United States, the two major world powers after World War II.

Immigration

The action of coming to live permanently in a foreign country.

Twenty-First Century

The current century, marked from the year 2001 to 2100, characterized by rapid technological advancements and globalization.

Q5: The yield to maturity on a bond

Q33: Two brothers each open IRAs in 2009

Q37: Based on the information in Table 4-2,and

Q40: Clothier,Inc.has a target capital structure of 40%

Q45: Which of the following investments is clearly

Q57: All of the following are criticisms of

Q84: The profitability index is the ratio of

Q105: A company with a bond rating of

Q135: Project XYZ requires an initial outlay of

Q142: The future value of a 10-year ordinary