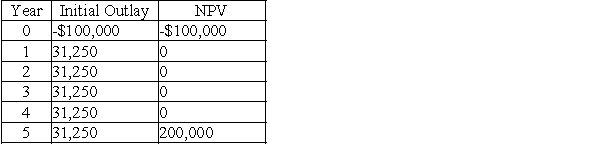

The Bolster Company is considering two mutually exclusive projects:

The required rate of return on these projects is 12 percent.

The required rate of return on these projects is 12 percent.

a.What is each project's payback period?

b.What is each project's discounted payback period?

c.What is each project's net present value?

d.What is each project's internal rate of return?

e.Fully explain the results of your analysis.Which project do you prefer,and why?

Definitions:

Mechanisms of Learning

The processes and techniques through which individuals acquire new knowledge, behaviors, attitudes, or skills.

Variable-Interval Schedule

A reinforcement schedule in operant conditioning where a response is rewarded after an unpredictable amount of time has passed.

Operant Conditioning

A method of learning that employs rewards and punishments for behavior, encouraging the subject to associate certain behaviors with consequences.

Unpredictable Basis

Lacking a consistent or predictable foundation, often leading to random or variable outcomes.

Q6: A firm's dividend policy includes two basic

Q18: The EBIT-EPS indifference point is the level

Q24: Stock repurchases do not alter a company's

Q34: Miller's preferred stock is selling at $54

Q46: Due to a number of lawsuits related

Q55: What is the value of a preferred

Q96: The initial outlay includes the cost of

Q131: Your firm is considering an investment that

Q140: A major disadvantage of the discounted payback

Q148: Business risk refers to the relative dispersion