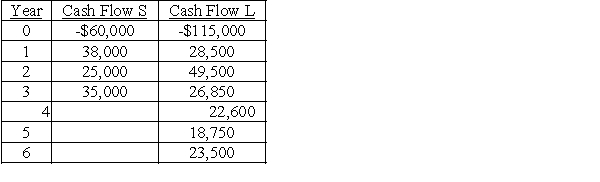

The Meacham Tire Company is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.

The required rate of return on these projects is 14 percent.What decision should be made?

The required rate of return on these projects is 14 percent.What decision should be made?

As part of your answer,calculate the NPV assuming a replacement chain for Project S,and also calculate the equivalent annual annuity for each project.

Definitions:

Political Risk

The risk of losses due to changes in a country's political landscape or government policies that can affect investments or operations.

Licensing Agreement

A legal contract allowing one party to use another party's property or intellectual property under specified conditions.

Regional Economic Alliance

An agreement among countries in a specific geographic area to reduce trade barriers and increase economic cooperation.

Political Risk Analysis

The evaluation of how political events and conditions in a country affect the business environment and investment stability.

Q19: The tax shield on interest is calculated

Q23: Using simulation provides the financial manager with

Q39: If markets were entirely efficient (perfect),which of

Q59: The Modigliani and Miller hypothesis does not

Q78: The change in the value of a

Q85: Jones Company expects the following results in

Q106: Atlas Corporation wishes to estimate its cost

Q118: Investor A owns 10% of the common

Q137: Which of the following statements would be

Q139: In a replacement decision,the initial outlay is