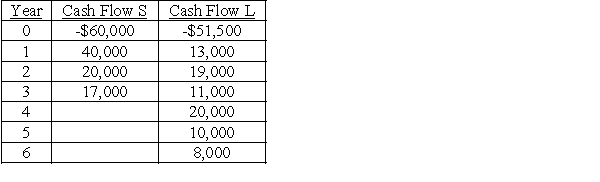

The Dickerson PR Firm is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Calculate the equivalent annual annuity for each project assuming a required return of 15%.What decision should be made?

Definitions:

Esophageal Varices

Swollen, varicose veins located in the lining of the lower esophagus, often a complication of liver disease and can lead to life-threatening bleeding.

Failure To Thrive

A condition often seen in children, characterized by slower physical development and growth than normal for their age.

Broken Nose

A fracture of the bones of the nose, typically resulting from trauma, leading to pain, swelling, and sometimes difficulty breathing.

Residual Volume

The amount of air remaining in the lungs after a forceful exhale, preventing lung collapse.

Q11: A company's capital structure mix is based

Q26: A firm's cost of capital is not

Q28: Taste Good Chocolates develops a new candy

Q31: Calculate the value of a bond that

Q78: The change in the value of a

Q95: A decrease in the level of production

Q96: The initial outlay includes the cost of

Q108: Private equity funds tend to focus their

Q112: Gibson Industries is issuing a $1,000 par

Q121: Who bears the greatest risk of loss