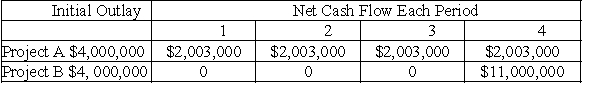

Consider the following two projects:

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

a.Calculate the net present value of each of the above projects,assuming a 14 percent discount rate.

b.What is the internal rate of return for each of the above projects?

c.Compare and explain the conflicting rankings of the NPVs and IRRs obtained in parts a and b above.

d.If 14 percent is the required rate of return,and these projects are independent,what decision should be made?

e.If 14 percent is the required rate of return,and the projects are mutually exclusive,what decision should be made?

Definitions:

Opportunity Costs

The loss of potential gain from other alternatives when one alternative is chosen, representing the benefits one misses out on when making a decision.

Excess Capacity

Excess capacity refers to a situation where a company is operating below its maximum output level, indicating that it can produce more with the current resources if there is higher demand.

Expansionary Fiscal Policy

To fight recessions, the federal government lowers taxes and/or raises spending.

Government Spending

Expenditures made by the government of a country on collective needs and wants such as infrastructure, public safety, education, and healthcare.

Q42: Based on the data contained in Table

Q53: A project's net present value profile shows

Q62: Proceeds from the issuance of new debt

Q69: Financing a portion of a firm's assets

Q78: The change in the value of a

Q83: Which of the following would not be

Q84: The viewpoint that low dividends increase stock

Q124: Alaska Power Company issued $1,000 bonds that

Q141: Security markets are considered to be perfect

Q152: If a project uses an asset the