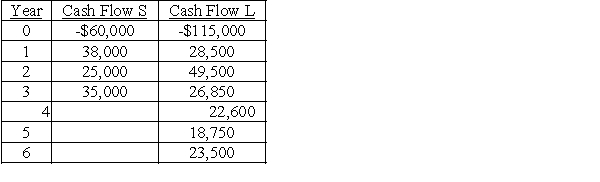

The Meacham Tire Company is considering two mutually exclusive projects with useful lives of 3 and 6 years.The after-tax cash flows for projects S and L are listed below.

The required rate of return on these projects is 14 percent.What decision should be made?

The required rate of return on these projects is 14 percent.What decision should be made?

As part of your answer,calculate the NPV assuming a replacement chain for Project S,and also calculate the equivalent annual annuity for each project.

Definitions:

Neurological Disease

Disorders of the nervous system, affecting the brain, spinal cord, and nerves throughout the body.

Esophageal Cancer

A type of cancer that occurs in the esophagus, the long tube that connects the throat to the stomach, often associated with difficulty swallowing and weight loss.

Regurgitation

The backward flow of blood through a valve in the heart that does not close properly, or the return of undigested food from the esophagus to the mouth.

Difficulty Swallowing

Known medically as dysphagia, this term describes trouble moving food, liquid, and saliva from the mouth to the stomach.

Q37: A stock repurchase plan that involves issuing

Q41: Project ZZQ requires an initial outlay of

Q53: Cryptic Corporation has 10 million shares of

Q56: Baseheart,Inc.expects its current annual $2.50 per share

Q62: The break-even quantity of output is that

Q72: An increase in a corporation's marginal tax

Q124: Business risk refers to<br>A) the risk associated

Q126: A preferred stock that pays an annual

Q126: Sunk costs are cash outflows that will

Q151: Because financial markets can be extremely volatile,with