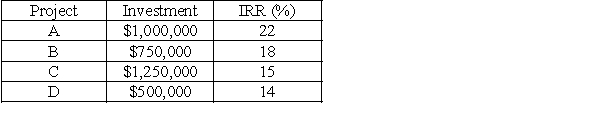

The Clydesdale Corporation has an optimal capital structure consisting of 70 percent debt and 30 percent equity.The marginal cost of capital is calculated to be 14.75 percent.Total earnings available to common stockholders for the coming year total $1,200,000.Investment opportunities are:

a.According to the residual dividend theory,what should the firm's total dividend payment be?

a.According to the residual dividend theory,what should the firm's total dividend payment be?

b.If the firm paid a total dividend of $675,000,and restricted equity financing to internally generated funds,which projects should be selected?

Assume the marginal cost of capital is constant.

Definitions:

Methane Gas

A colorless, odorless flammable gas that is the simplest alkane, consisting of one carbon atom and four hydrogen atoms, widely used as a fuel.

Complete Combustion

A chemical reaction in which a compound reacts with an oxygen-rich environment to produce a complete oxidation, releasing maximum energy.

Ethanol

A volatile, flammable, colorless liquid, commonly known as alcohol, used in beverages and as a solvent or fuel.

Complete Combustion

A chemical process in which a compound, usually a hydrocarbon, reacts fully with an abundant supply of oxygen to produce carbon dioxide, water, and energy.

Q8: The break-even model assumes that selling price

Q34: Dorian Industries' projected sales for the first

Q34: The CEO of Marletti Pasta Company wants

Q86: Pro forma financial statements depict the end

Q87: Trade credit appears on a company's balance

Q96: The initial outlay includes the cost of

Q114: Three of the most common options that

Q134: It is often the case that the

Q146: Trade credit is an example of which

Q164: Benkart Tool and Die Company plans to