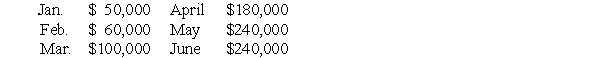

Fielding Wilderness Outfitters had projected its sales for the first six months of 2010 to be as follows: Cost of goods sold is 60% of sales.Purchases are made and paid for two months prior to the sale.40% of sales are collected in the month of the sale,40% are collected in the month following the sale,and the remaining 20% in the second month following the sale.Total other cash expenses are $40,000/month.The company's cash balance as of March 1st,2010 is projected to be $40,000,and the company wants to maintain a minimum cash balance of $15,000.Excess cash will be used to retire short-term borrowing (if any exists) .Fielding has no short-term borrowing as of March 1st,2010.Assume that the interest rate on short-term borrowing is 1% per month.How much short term financing is needed by March 30,2010?

Cost of goods sold is 60% of sales.Purchases are made and paid for two months prior to the sale.40% of sales are collected in the month of the sale,40% are collected in the month following the sale,and the remaining 20% in the second month following the sale.Total other cash expenses are $40,000/month.The company's cash balance as of March 1st,2010 is projected to be $40,000,and the company wants to maintain a minimum cash balance of $15,000.Excess cash will be used to retire short-term borrowing (if any exists) .Fielding has no short-term borrowing as of March 1st,2010.Assume that the interest rate on short-term borrowing is 1% per month.How much short term financing is needed by March 30,2010?

Definitions:

Technological Advance

Improvements in technology that increase productivity and lead to new products or more efficient processes.

R&D Spending

The amount of financial resources allocated by organizations on research and development activities aimed at creating new products or improving existing ones.

Interest-Rate Cost

The cost incurred by an individual or entity due to borrowing funds, determined by the rate of interest on the borrowed amount.

Marginal Utility

The additional enjoyment or gain achieved by consuming another unit of a good or service.

Q27: A foreign currency option differs from a

Q40: The problem with the constant dividend payout

Q48: Over the relevant range of output,fixed costs

Q82: Benkart's Tire Store has fixed costs of

Q99: JB Appliance,Inc.stock is currently selling for $20

Q102: Payable through drafts<br>A) provides for effective control

Q114: Three of the most common options that

Q116: Williams Toy Company will use an estimated

Q119: The optimal capital structure occurs when operating

Q135: The selection of a proper marketable-securities mix