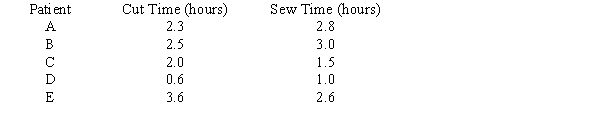

A new surgical facility called Cut & Sew is opening in neighborhoods throughout the United States. They are job shops that handle a variety of outpatient surgical procedures. Their process is set up so that one doctor cuts and the other sews. They have five patients to sequence for tomorrow. Since the weather forecast is for a cool and sunny day, they would also like to play golf tomorrow. They want to sequence their patients with the objective of minimizing the time from the beginning of the first job until the finish of that job. The patients and estimated times are as follows:  Sequence the patients using Johnson's Method, state the schedule for each operation, and determine the minimum makespan.

Sequence the patients using Johnson's Method, state the schedule for each operation, and determine the minimum makespan.

Definitions:

Common-Size Balance Sheet

A financial statement that presents all items as percentages of a common base figure rather than absolute numerical figures, facilitating comparison.

Shareholders' Equity

The residual interest in the assets of a corporation that remains after deducting liabilities, representing the ownership interest of shareholders.

Total Assets

The sum of all assets owned by a company, including cash, inventory, property, and intangible assets, represented on the balance sheet.

Deferred Income Taxes

Taxes applicable to income that is recognized in the financial statements in one period but is taxable in another.

Q12: Which one of the following structures represents

Q16: The Shortest Processing Time (SPT) rule<br>A)Ensures that

Q19: A type of organization which "loans" resources

Q20: Both economic and noneconomic factors should play

Q25: Rank each set of substituents using the

Q33: Assigning people to tasks, setting priorities for

Q39: Which of the following is not a

Q47: Average inventory in the EOQ model is

Q49: A company has a PERT project with

Q59: The Supply Chain Operations Reference (SCOR) Model