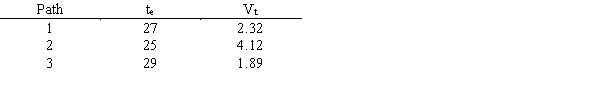

A company has used PERT for a project and wants to minimize the probability of overrunning a contract deadline of 30 weeks. Three paths of concern in the PERT network have these mean durations and variances in weeks:

a.What is the Z-score for path 1?

b.What is the probability of path 2 overrunning the deadline?

Definitions:

Risk Premiums

The extra return expected by investors for taking on the risk of an investment compared to a risk-free asset.

Mean-variance Efficient

A portfolio that offers the highest expected return for a defined level of risk or the lowest risk for a given level of expected return.

CAPM

The Capital Asset Pricing Model is a conceptual model employed to calculate the anticipated return on an investment, taking into account both the risk associated with the investment and the time value of money.

Market Portfolio

A theoretical portfolio that includes all assets available in the market, each weighted by its market capitalization, often used in the Capital Asset Pricing Model (CAPM).

Q11: Explain how a bill of materials (BOM),

Q11: Draw the structure of a five carbon

Q18: Name these groups (left to right). <img

Q21: Which aggregate planning strategy generally would result

Q24: To compute the critical path, we assign

Q41: A process is considered to be in

Q59: All of the following relate to Six

Q71: Both consultants and business professionals now agree

Q76: A Procter and Gamble factory process fills

Q81: In MRP, it is essential that all