The City of Carlsbad established a Stores and Services Fund.To provide working capital,the Stores and Services Fund borrowed $800,000 from the General Fund,to be paid back over 8 years with no interest.The Stores and Services Fund is expected to set user charges at a level which will recover all expenses and provide cash for the repayment of the loan.

Capital assets used by the Stores and Services Fund include a building which cost $350,000 and had a 10 year life,and equipment which cost $200,000 and had a 5 year life.Straight-line depreciation is to be used,with no salvage value.

Capital assets used by the Stores and Services Fund include a building which cost $350,000 and had a 10 year life,and equipment which cost $200,000 and had a 5 year life.Straight-line depreciation is to be used,with no salvage value.

Required:

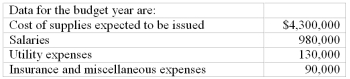

a.Prepare a break-even budget for the City of Carlsbad Stores and Services Fund.Include a mark up percentage,as a percentage of cost so that revenue will equal expenses.

b.Record the issuance of supplies,costing $16,500,to the Water Utility Fund.The perpetual inventory system is used.Show computations in good form.

Definitions:

Stockholders' Equity

The portion of the balance sheet that represents the capital received from investors in exchange for stock, plus retained earnings or losses.

Common Stock

Equity security that represents ownership in a corporation, with holders typically having voting rights and potential dividends.

Depreciable Asset

A Depreciable Asset is a tangible asset subject to depreciation, which allows for the allocation of its cost over its useful life.

Capital Expenditure

Money spent by a business to acquire, upgrade, and maintain physical assets such as property, industrial buildings, or equipment.

Q1: Capital projects funds are established by a

Q22: Proprietary funds are required to have a

Q40: Wages that have been earned by the

Q54: Enterprise funds use the economic resources measurement

Q54: What amount would be reported as debt

Q57: Assume a government is a special-purpose entity

Q61: Contributions to a private not-for-profit are recorded

Q88: Postclosure costs are recorded in a solid

Q102: Proprietary funds use the accrual basis of

Q106: Worksheet entries are used to convert modified