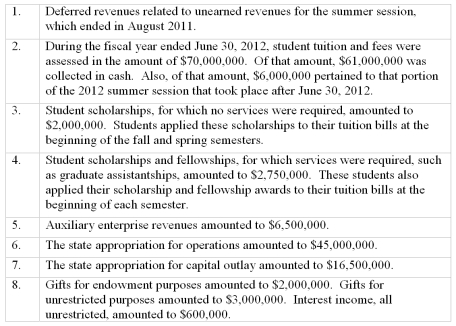

Southeastern State University has chosen to report as a public university reporting as a special purpose entity engaged only in business-type activities.Deferred Revenues were reported as of July 1,2011 in the amount of $7,600,000.Record the following transactions related to revenue recognition for the year ended June 30,2012.Include in the account titles the proper revenue classification (operating revenues,nonoperating revenues,etc.):

Definitions:

Q1: Private colleges and universities are subject to

Q4: Contrast a defined benefit and defined contribution

Q11: Both public and private sector health care

Q13: A "performance indicator" is required in the

Q24: Customer's meter deposits which cannot be spent

Q71: What is the difference between a component

Q86: Private health care organizations follow _ standards

Q110: Which of the following tax-exempt organizations would

Q113: Which of the following is not an

Q126: Funds that are restricted for a certain